We know that Warren Buffett, the Oracle of Omaha, says that you should invest in low-cost index funds, saying that their low fees make all the difference in performance and growth of your portfolio in the long-term.

But even though he’s clearly not primarily an index fund investor, he’s willing to put his money where his mouth is.

At the end of 2007, Buffett challenged anyone in the hedge fund industry to a big bet: the performance of their chosen hedge fund versus a Vanguard S&P 500 index fund over the next ten years.

Here’s how he explains it, in his 2016 letter to Berkshire-Hathaway shareholders:

I publicly offered to wager $500,000 that no investment pro could select a set of at least five hedge funds – wildly-popular and high-fee investing vehicles – that would over an extended period match the performance of an unmanaged S&P-500 index fund charging only token fees. I suggested a ten-year bet and named a low-cost Vanguard S&P fund as my contender.

Hedge fund manager Ted Seides of Protégé Partners accepted the bet, choosing five funds-of-funds encompassing more than 100 total hedge funds.

Says Buffett:

Each fund-of-funds, of course, operated with a layer of fees that sat above the fees charged by the hedge funds in which it had invested. In this doubling-up arrangement, the larger fees were levied by the underlying hedge funds; each of the fund-of-funds imposed an additional fee for its presumed skills in selecting hedge-fund managers.

You can imagine where this is going.

The bet, which was supposed to run until the end of 2017, was conceded by Seides in September because his funds are so far behind the Buffett’s S&P 500 fund … and it’s not even funny.

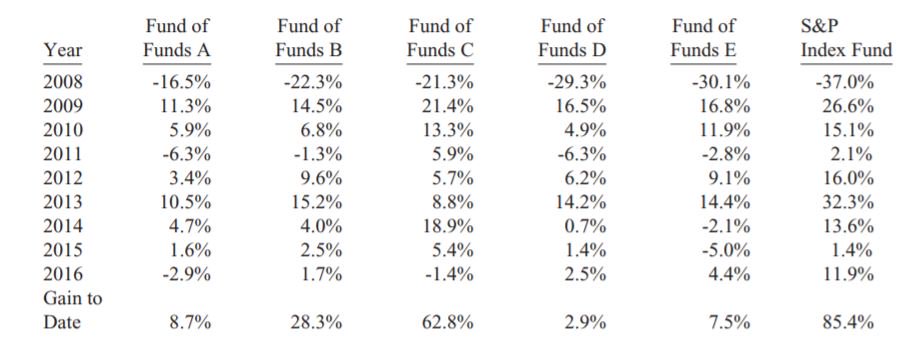

Here’s the data:

The problem for Seides is his five funds through the middle of this year have been only able to gain 2.2 percent a year since 2008, compared with more than 7 percent a year for the S&P 500 — a huge difference.

That means Seides’ $1 million hedge fund investments have only earned $220,000 in the same period that Buffett’s low-fee investment gained $854,000.

“For all intents and purposes, the game is over. I lost,” Seides wrote. The $1 million will go to a Buffett charity, Girls Inc. of Omaha.

Obviously, this real-world example proves what we’ve been advocating for years — active management doesn’t work. It’s not that smart people can’t get lucky and choose funds that have growth, but it’s almost impossible to do it over the long-term AND overcome the additional fees those fund managers cost their investors.

“A lot of very smart people set out to do better than average in securities markets. Call them active investors,” writes Buffett. “Their opposites, passive investors, will by definition do about average. In aggregate their positions will more or less approximate those of an index fund.

“Therefore, the balance of the universe—the active investors—must do about average as well. However, these investors will incur far greater costs. So, on balance, their aggregate results after these costs will be worse than those of the passive investors.”

Don’t make fund managers rich with your money; keep more of your money so you’re the one getting rich.